Николай Камзин - The implementation of the economic cycle: freedom, trust, duty

- Название:The implementation of the economic cycle: freedom, trust, duty

- Автор:

- Жанр:

- Издательство:неизвестно

- Год:неизвестен

- ISBN:978-3-659-13623-8

- Рейтинг:

- Избранное:Добавить в избранное

-

Отзывы:

-

Ваша оценка:

Николай Камзин - The implementation of the economic cycle: freedom, trust, duty краткое содержание

The implementation of the economic cycle: freedom, trust, duty - читать онлайн бесплатно ознакомительный отрывок

Интервал:

Закладка:

There are also quotes an official, interbank, exchange-traded. The official exchange rate quotation by the Central Bank. The official exchange rate used for accounting purposes and customs payments for the balance of payments.

Methods for determining the official exchange rate varies by country depending on the nature of the monetary system and exchange rate regime. In countries where the fixed exchange rate regime, the quotation is determined purely by administrative means. The Central Bank sets (regardless of supply and demand for currency) exchange rate against the currency of any one country to which the «tied» the currency of that country, or in relation to several currencies at once (on the basis of the «currency basket») or SDRs. At the same time the Central Bank may establish different exchange rates for individual operations (multiplicity of exchange). This method was used in the Russian Federation until July 1992.

Under the regime of «currency corridor» official exchange rate set under the «currency corridor», or at the level of the exchange (as, for example, in Russia from July 1995 to May 1996) or by daily quotations, the so-called «sliding fixation».

In some countries with underdeveloped exchange market, where the main circulation of currency transactions pass through the currency market, the official rate set at the level of the exchange.

In countries with a free currency market, where a regime of «floating» rate, depending on the prevailing supply and demand for foreign currency, central banks set the official exchange rate at the interbank level. In some industrialized countries maintained a tradition of setting the official exchange rate at the level of the exchange.

Since the bulk of foreign exchange operations in industrialized countries are carried out on-the-counter interbank market, the main course of the internal market in these countries is the interbank rate. Interbank quotation installs large commercial banks – the main operators of the foreign exchange market, supporting one another permanent relationship. They are called market makers (makers of the market).Other banks – market-users (users of the market) to apply for quotation of market makers. Interbank Foreign Exchange quotes are set by market makers by sequential comparison of supply and demand for each currency.

On the interbank rates are guided all the other members of the currency market, it is the basis of establishing rates for each currency. Exchange rate is mostly for reference.

In countries with rigid exchange restrictions and fixed exchange rate, all operations are conducted at the official rate. In some countries with underdeveloped exchange market, where the volume of currency transactions are in foreign currency exchange rate of the main foreign exchange market is the exchange quotation, which is formed on the exchange, based on the consistent comparison of bids for the purchase and sale of foreign currency (exchange fixing). Exchange rate is the basis of establishing rates, both in interbank transactions and for bank customers.

Distinguish quotes:

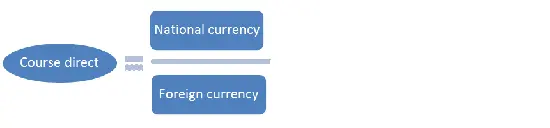

– The lines are used in most countries (including Russia). When direct quotation cost per unit of foreign currency expressed in national currency unit (for example, U.S. $ 1 = 29.64 RUR):

– Indirect, the unit adopted a national currency, the rate of which is expressed in a certain amount of foreign currency. Indirect quotation is used in the UK, since 1987, and in the U.S. (for example, 1 RUR = 0.034 U.S. dollar).

Between direct and indirect quotations of the inverse relationship exists:

The display of exchange rates of a large bank of any country is induced by the dollar against other currencies that is, represented by direct quotation.

For the British pound has historically maintained an indirect quotation, so the string GBP in this table is read as follows:

1 pound = 1.62 U.S. dollar

– Cross-rate is the ratio between the two currencies in relation to third currencies.

For example, on April 10, 2012 Bank of Russia [38] http://cbr.ru

set for accounting purposes and customs payments the following rates:

1 U.S. dollar = 29.64 RUR.

4. Foreign exchange operations

The most common is separation of currency transactions in cash and term. The first is also called the overnight (overnight). In this case we are talking about the provision of goods (currency) at the time of the transaction or within a few days, in the second – about the time lag between the date of the transaction and its implementation.

4.1. Cash Transactions (transaction «spot»)

Transactions on a «spot» (spot – cash, instant) made at the rate established at the time of the agreement, and the supply of currency no later than the second enterprise day. Delayed pay increases progressively fine-interest.

At the heart of deals «spot» is based on correspondent relationships among banks.

– The spatial arbitrage. This foreign currency transaction had to start spontaneously dealers. Profit arises from differences in the courses on various foreign exchange markets.

Under normal conditions, currency trading is, in its macroeconomic consequences, to a positive phenomenon, because it promotes the equalization of market rates. But inflation in the atmosphere an additional influx of a particular currency may cause the exchange rate distortions.

In a simple arbitrage interact two counterparties. Buyer shall pay from their bank accounts, dealer – acting on the orders of the first (or in conjunction with them) – accrues revenue. Their foreign exchange reserves as a whole does not change.

Complex or the conversion arbitrage involves working with a number of currencies in different markets. The study of the geography of currency rates reveals a point relative to cheaper foreign currency purchase. Broker like climbing the stairs, exchanging currency purchased on the third and fourth. And back to the original currency is not necessary.

Arbitration profit extremely unstable and conversion operations involve a risk to stay in the position outright in any link.

– Cross-operation – this is the equation of one currency to another through a third – the National, the country where the transaction or that the fairly widespread in world currency markets, through a preliminary equalization rates to the dollar.

In Russia, the cross-denominated transactions are carried out mediation when dealing with «soft» currencies.

Cross – the operation used a combination of foreign exchange purchase and sale of securities.

But the use of cross-operation is fraught with the risk of exchange rate changes between the first and second acts of the transaction. Sometimes, to avoid losses, it is necessary to involve a third or fourth transaction currency.

4.2. Forward contracts

Urgent or forward contracts are two-fold objective: profit-in the form of foreign exchange and insurance of participants against currency risks.

Emergency surgery for the sale (purchase) of foreign currency consists of the following conditions:

– The course of the transaction is recorded at the time of its conclusion;

– Transfer of currencies is carried out in 1 – 3 months (sometimes deadline is extended to one year);

– At the time of the transaction no amounts of accounts are generally not performed.

Forward exchange transaction occurred as a form of insurance for foreign trade operations. If the goods are sold on credit, the exporter seeks to preserve the value of its currency now existing rate. The importer, buying goods on credit and insuring them against the appreciation of the currency of the country of origin, may act as a buyer of the currency at a fixed time of the transaction rate.

Forward transactions are bank lenders seeking to guarantee itself against a possible depreciation of currency, which provided a loan.

Common in international practice has focus on the rate of «LIBOR» (London: Inter Bank Offered Rate) – the interest on interbank deposits in London.

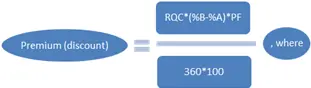

Calculation of the premium (discount) to the forward rate by the following formula:

RQC – rate quoted currency;

% B – the rate on deposits in foreign currency B;

% A – the rate on deposits in foreign currency A;

PF – period forward.

The enterprise press usually puts the data on exchange rates of CIS countries and the interest rates on deposits. However, in this currency environment plays a significant role time unpredictability, non-economic conditions, foreign exchange rates on forward transactions are contractual in nature.

4.3. Deal with an option

In contrast, forward transactions with exact delivery date, united by the concept of «outright» (outright), option (a choice) does not fix the date of delivery. Distinguish between temporary options, options buyers and sellers. In all cases we are talking about the fact that one party pays the other an additional premium, but instead gets some special right. In the temporary option, for example, the right timing of currency supply. The bank sells foreign currency to the client on the forward rate «+» an extra bonus with the deadline for delivery. But the customer gets the right to demand payment at any time during a fixed period. Such an option could be very advantageous for particular variations in market exchange rates.

If the option is received (for a premium) the buyer, then as a matter of choice may be, and the right to refuse to accept the exchange of goods. Here, premium – premium plays the role of compensation. Right out of the deal for the forward period, and may belong to the seller who pays a premium to the buyer.

4.4. Transaction «swap»

Today, the transaction «swap» – is the purchase or sale of currency under a fixed exchange rate, but at the same time the conclusion of the reverse forward transaction, and payment terms are usually not the same (deal «sell-buy» in the jargon of the foreign exchange market). The swap transaction is used to cover the currency risk, as well as a possible gain in the future.

For example, somebody buys dollars for rubles a month for delivery and immediately makes a deal to sell them. Forward selling rate (is percentage price premium dollar) is the subject of the contract.

For interbank relationships swap transaction – an exchange of obligations or requirements, a form of insurance against risk, diversification, and replenish reserves.

The swap agreements between central banks are foreign currency exchange amounts (loans) to the short term, the exchange, which decays to the acts of buying foreign currency (for the target of intervention) and resell foreign currency.

Such agreements are common between the U.S. Federal Reserve and central banks of European countries. European Monetary Cooperation Fund – a prototype of the European Central Bank – interacted with the participants of the European Community based on three-month renewable constantly swap agreements.

Читать дальшеИнтервал:

Закладка:

![Джеймс Купер - Пионеры, или У истоков Саскуиханны [The Pioneers, or The sources of the Susquehannah]](/books/1066142/dzhejms-kuper-pionery-ili-u-istokov-saskuihanny-t.webp)