Rick Page - Make Winning a Habit [с таблицами]

- Название:Make Winning a Habit [с таблицами]

- Автор:

- Жанр:

- Издательство:неизвестно

- Год:неизвестен

- ISBN:нет данных

- Рейтинг:

- Избранное:Добавить в избранное

-

Отзывы:

-

Ваша оценка:

Rick Page - Make Winning a Habit [с таблицами] краткое содержание

A master of the complex sale and a bestselling author, Rick Page is also one of the most experienced sales consultants and trainers in the world. Make Winning A Habit defines the gap between what companies know to do and how they consistently perform.

Page clearly identifies five “Ts” of transformation: Talent, Technique, Teamwork, Technology and Trust. These five elements, when fully developed and integrated into the sales and marketing organization, begin to create the habit of winning over customers in every industry. Stories of successes-and failures-from members of prominent companies help you apply the five “Ts” to your company's culture, and point the way to more effective plans for motivating employees, building and coaching winning teams, and improving hiring processes.

Then, with the use of Page's assessment scorecard, you can compare your company with some of the strategies and practices of the best sales forces in the world. Designed to gauge your organization's effectiveness and further develop breakthrough sales growth, this scorecard highlights your strengths and weaknesses, helping you bridge the gap between where you are and where you need to be.

You'll also learn about:

The “Deadly Dozen” (pains sales managers feel today) and how they can kill business

A ten-point process for identifying and hiring nothing less than “A” players

The 8 “ates” of managing strategic accounts and how they will maximize revenue and elevate relationships

How to identify and correct the six most common areas of poor individual sales performance

With Make Winning A Habit, you'll discover the obstacles between you and the consistent sales performance you can achieve-and find the tools to not only make success a habit, but one that will keep growing with your business.

Make Winning a Habit [с таблицами] - читать онлайн бесплатно полную версию (весь текст целиком)

Интервал:

Закладка:

As managers, they then clone more salespeople with bad habits. At the same time, there is a whole new generation of salespeople out there who not only need the fundamental skills of selling but also need to understand the complexities of committee sales and major accounts.

Sales managers have an even more difficult challenge than others because the skill sets they need to coach their people are much different from what is needed to coach a deal , yet they are intricately entwined. The trap is that many managers become “inspectors” instead of coaches, doing deal reviews without asking the tough questions or adding value by improving the strategy.

Many sales executives are figuring out that they can no longer grow with the sales techniques that have gotten them to where they are now. While coaching deals might have been an option in the up economy, it is essential in a down or flat economy. The new managers who were salespeople in the up economy may never have learned how to really analyze and coach a competitive deal.

Today’s Economy Affects the Way We Sell and the Talent Pool

One discovery we’ve made since the last book is the impact of an up economy and a down economy on the way sellers sell and the way buyers buy. The change in the economy has had a significant impact on the talent pool for salespeople and managers and the competencies they bring with them.

In the boom economy of the 1990s, a lot of bad habits were allowed to continue. As Jim Dickie, of CSO Insights, says, “In a hurricane, even turkeys can fly.”

There were some poor role models among salespeople and managers and a lot of mediocrity in selling that still resulted in high sales because it was a seller’s market.

These poor selling habits came back to roost when the market turned down. Many of the “one-year wonders” could not compete effectively in the new, tougher selling environment.

Several things began to happen. First, in the consulting world, salespeople had gotten used to proposal lobbing—answering 10 RFPs, throwing them over the castle wall, and winning two, which was enough to keep people off the bench.

In the down economy, there was no longer enough business to keep consulting firms busy. Our phone began ringing off the hook as those firms realized that they needed to get more competitive and better at selling in order to win their share or even grow.

Many consulting firms began to develop sales processes, hire outside business developers, and focus on sales training. While making significant improvements, one challenge still remains in the consulting industry—and that is the lack of an overall sales hierarchy and sales management and accountability infrastructure, as well as a hiring profile that leads to a competitive culture.

The Lost Art of Prospecting

In the rest of the sales world, we began to get a lot of calls from sales executives who said, “You told us how to win deals, but we don’t have enough deals to work on in this economy. Our pipelines aren’t full enough.”

Salespeople had forgotten how to prospect because they didn’t need to for the past 10 years. Instead, they had let marketing handle this responsibility. They had forgotten how to pick up the phone and call a stranger or felt that they were past that in their careers.

At the same time, executives today are barraged by more people than ever trying to get to them—through e-mail and voicemail—so the clutter is even greater. We work with a number of firms to help them refocus their prospecting efforts and demand-creation selling: how to get to executives, how to do research before you get there, and how to identify their top two or three issues so that the chances of a voice-mail or e-mail creating a 30-minute meeting actually may have some chance of working.

The goal is to identify an executive who will sponsor a project and find a budget in the absence of an evaluation.

Procurement Grows Stronger — Commoditization

Another impact of the down economy is that procurement has gained more power. Procurement has always been a stakeholder, with greater strength in government than in the commercial sector. In the down economy, though, its strength has grown as efforts have increased to drive cost out of companies so that they can compete globally.

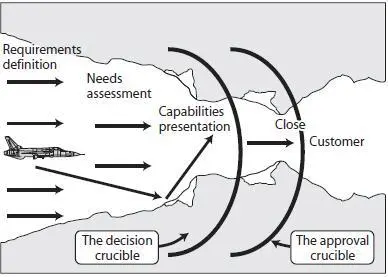

As a result, sales cycles, after the vendor-selection decision, have developed a second crucible for the approval cycle, which can be as difficult and lengthy as the process for winning the business itself. This means that after earning the business, we need to better equip our sponsors with a business case for the economic buyer.

The best practice is to become more proactive in this phase of the process rather than leaving it up to the client.

As the economy declines, companies focus on cost cutting rather than on innovation or revenue-generating activities. This has been reinforced by the global impact on prices from low-cost producers in Asia. As a result, procurement has more power, even over strategic purchases.

By nature, procurement is inclined to ignore value and focus on price. In fact, procurement managers are measured and rewarded for it. The end users are the ones who understand value. This is why procurement people try to separate you from them at the end of the sale. Commoditization is not only a sport to these people, it is also a way of life. Even when they understand strategic value, they are trained to ignore it — at least in front of you.

They will say such things as, "I don't know. You all look the same to me, but you're more expensive. What can you do for us on the price?" Left unchecked, these people will drive you to the door and then catch you by the coattails.

Also remember that there is a mirror image of client relationship management (CRM) for procurement people called supplier relationship management (SRM). Also called strategic sourcing, procurement best practices call for segmenting suppliers into different categories based on the importance of their value and the availability of substitutes.

This gives them four segments:

• High importance, low substitutability — strategic

• High importance, available substitutes — preferred vendor

• Low importance, low substitutability — manage risk

• Low importance, available substitutes — commodity

Many procurement people actually know the difference between buying strategic solutions and buying commodities, but they often pretend that you have less value to their firm than you do. Moreover, ERP systems for the bigger firms now provide procurement with information about global spending with your organization, as well as prices your firm has quoted elsewhere in the world. This is information the sales reps themselves often don’t have. And information is becoming available through consultants about what prices were quoted to other firms.

While they focus on price, you must continue to refocus on value. They will argue over thousands while you may be making them millions. Where do you find this value? From the initial discovery and linking your solutions up the value chain.

At the same time, the attorneys are paid to imagine the worst possible outcome — litigation — and many want to prelitigate in the contract. You need the powerful executives who will be using your products and services to explain what is normal risk, what can and cannot be achieved, and your competitive differentiators and their value. Without their involvement negotiated early in the sales cycle, you will find yourself in a battle of wits with lawyers and procurement—unarmed (see Figure 5–1).

In our negotiating classes, we teach that the best practice is to bargain early in the sales process, while you have something to trade, to get your sponsors to advocate for you with procurement. Why would they do this for you? Remind them that their future depends more on the success and risks of the project or product than on negotiated price—and that a degree of partnership will be necessary for the future give and take.

Remind them that the relationship includes the negotiation. And you can’t go from partnership to abuse and back to partnership—especially if you have taken all the margins out of the deal. If they don’t agree to arbitrate value on your behalf later, you might seriously consider not investing further resources if you see a price beating coming in your future. We have a commodity buyer who has called us every year for six years. We have fired the buyer as a prospect every year. We know the company won’t pay for value in the end. We spend a little time to see if the company’s culture has changed or if the company representative person has enough power. If not, we move on.

Understand your value, continuously refocus the discussion around it, and never go to procurement alone. (Although you actually may have to physically go by yourself, your sponsors should have paved the way and be in the background, supporting your value.)

Value-Based Account Segmentation

There are many ways to segment accounts in a market. Since you cannot and should not invest in all accounts equally, deciding in advance which accounts will yield the greatest return on investment of additional time and resources is obviously a key decision. Traditionally, among the factors usually considered are historic revenue streams, reference-ability, account profitability, and quality of the relationship.

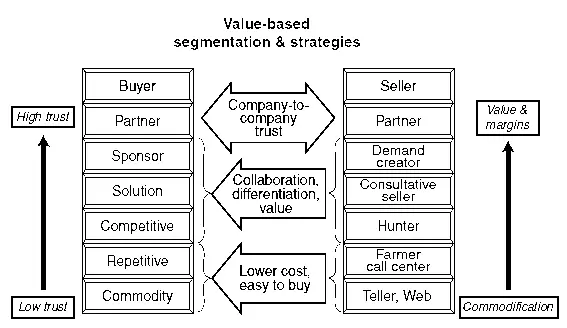

In Hope Is Not A Strategy, we defined six levels of buyer-seller relationships that have evolved over the years (see Figure 5–2). On the right side of the figure we define six levels and roles of sales talent that can be committed to an account. We also identify six different types of buyers based on the way they buy.

For firms selling value-added solutions rather than commodities, a developing best practice is to allocate resources and define strategies based on the way the customer is willing to pay for value. For example, if you commit partnering resources to commodity buyers, you will partner yourself broke lavishing attention on firms that will still put you out for bid.

For commodity buyers and repetitive buyers buying noncompetitive add-on sales, the strategy is to make it easy to buy and keep the cost of sales low using the Web or telesales. For buyers who buy in competitive evaluations, “hunters” who can manage and win these political battles are a necessity. If you put your “farmer” up against their “hunter,” you will get creamed.

A solution buyer will allow you to collaborate, understand his or her needs, and co-develop a customized solution with a consultative seller. This obviously takes a significant investment of both time and talent. A demand creator can find a dormant business problem and create a vision of a solution. Then he or she finds a sponsor who is a change agent with enough political power to drive the proposal into buying activity.

A danger exists in investing these resources and valueadded strategies if you are then going to be shoved down to procurement, only to have the value stripped out of your deal. The gamble is that you will have gained enough differentiation through collaboration that you are uniquely qualified to provide the solution and that your sponsors have enough power to arbitrate for you with procurement.

Читать дальшеИнтервал:

Закладка:

![Обложка книги Rick Page - Make Winning a Habit [с таблицами]](/images/nocover.webp)

![Сергей Снегов - Язык, который ненавидит [с иллюстрациями и текстовыми таблицами]](/books/1097573/sergej-snegov-yazyk-kotoryj-nenavidit-s-illyustrac.webp)