Alexander Kalashnikov - Construction for dummies in Russia: save money and mind

- Название:Construction for dummies in Russia: save money and mind

- Автор:

- Жанр:

- Издательство:неизвестно

- Год:2022

- ISBN:нет данных

- Рейтинг:

- Избранное:Добавить в избранное

-

Отзывы:

-

Ваша оценка:

Alexander Kalashnikov - Construction for dummies in Russia: save money and mind краткое содержание

Construction for dummies in Russia: save money and mind - читать онлайн бесплатно ознакомительный отрывок

Интервал:

Закладка:

3.6. blind area

Depending on the chosen type of facade, its installation begins either directly from the blind area, or with an indent from it by 20 mm – if a ventilated gap is needed. Therefore, before performing facade work, it must already be completed.

But there is a certain problem with the blind area – this is the state of the soil and its seasonal swelling. The condition of the soil can spoil both a single flooding of the site, and a change in the state of groundwater, showers, etc. In this case, improper performance of work on the blind area may lead to its rise.

From practice, the lifting height can be both 50 and 100 mm. Accordingly, the pressure from the blind area passes to the facade elements, crushing them like an "accordion", shifting the facade subsystem along with the cladding. As a rule, a gap is made between the profiles for thermal expansion of the metal, but it is only about 10 mm. Considering everything, in the best case, only the facade of the first floor, or its lowest part, may suffer, in the worst case, the deformation of the facade will go higher.

Therefore, the development of a project and a survey of the state of the soil in terms of the blind area during the construction of the facade are mandatory.

3.7. seismicity

The choice of facade materials, fasteners, etc. the seismicity of the area in which the object is located. Therefore, in areas with high seismic hazard, the materials used must be certified for use in such conditions, and in the event of earthquakes, they must minimize the risk of injury during failure. This also makes adjustments to the final appearance of the facade, its technology and cost.

3.8. Gaps between metal elements of the facade

Often, customers want the joints between the individual panels of the facades not to be visible and ask to make the installation without gaps. Alas, due to the thermal expansion of metals, facing materials can become unusable, deformed. Even designers forget about it, but you must remember and demand compliance with these standards.

3.9. The layout project of the profile system, cladding and individual components of the facade

Only at this design stage it is possible to see the future appearance of the facade as close to reality as possible, to see the visualization, to understand the cost of work and the need for materials.

But, now we have to wait for the decision of the supervisory authorities … And only then either correct the project, or finally start the work in accordance with the current regulations.

5. Learn how to properly plan money for project management: principles of cash flow ( cash flow ) in practice

It often happens that with the growth of a company or the number of projects or contracts it is carrying out, difficulties arise with planning further activities. The difficulty lies in understanding the question of whether you have enough resources, primarily financial, to complete the work in the future – from the next quarter to a year. Incorrect accounting of finances in this sense caused problems for many enterprises, especially when they took on additional, and in fact “unmanageable” projects at the expense of their own or borrowed funds, because they did not have enough resources at the right time, and to return what had already been invested in them was not possible. This includes, for example, all unfinished .

The second moment, when there is more than one project and they are extended in time, it means that the receipt of funds (revenue) from them will also be extended in time, and at some point, expenses in one project have to be made at the expense of proceeds from another, to the detriment of of course the second. Well, if there are 5 or 10 projects … Plus, such moments as unforeseen circumstances that shift both the execution of work on the project and the receipt of revenue.

Therefore, it is extremely important to distribute the efforts (expenses) and income in such a way that the incoming funds are enough for everything and do not lead to insolvency in certain periods. Getting into such situations, enterprises are forced to look for opportunities to attract additional financial resources (loans), which increases costs even more, and besides, the very receipt of these funds is not always possible for various reasons. Therefore, cash flow planning is a very important part of management, maybe even the most important.

Let's see how to organize and simplify all this.

In fact, there is nothing more visual than a graph or a simple table. In our case, we need a schedule for the receipt and expenditure of funds. But in order to build it, you need to set up accounting for two things.

1. Accounting for current and future costs and liabilities

The usual 1C type accounting system is not enough for this, either more advanced versions or more manual labor are needed. Programs usually show you the current situation – to whom you owe and how much, but your long-term plans will not get here and the data will not show you anything. Therefore, it is necessary to draw up a single schedule.

There are two types of expenses:

“ Prepaid ” – you spent money at a certain moment and received goods or services;

“With deferred payment” – you received goods and services, and you pay for them in a week or two, a month, and, if you're lucky, even after two.

The more detailed you set up planning, the better the result. But in general, the most convenient option is to conduct monthly planning. This should be reflected in the cost plan by date. In the “payment calendar” or “payment plan”, future expenses must be entered taking into account exactly when the need for payment arises, even if you have not yet received goods and services – we are planning for the future.

All expenses need to be planned. With permanent ones (rent, salary, taxes, loans, advertising, fuel, etc.) it is somewhat easier, half of them may not change from month to month, and each new project will require taking into account its specifics. There is no point in explaining how to build a cost plan by date or by project.

2. Accounting for income

In the same way as with expenses, we build a similar plan for cash receipts. For ordinary or core activities, it is relatively easy to plan these indicators. At the same time, each new project has its own specifics associated with the return on investment.

For example, if you take on the construction of an object for a year worth 120 million rubles, according to which the receipt of funds from the customer mainly occurs monthly upon completion of the work, which is stated in your contract, then on a monthly basis you can plan the receipt of revenue in the amount of 1/ 12 parts of the contract amount, i.e. 10 million rubles But some stages of work are more expensive, and some are cheaper – this must be planned and taken into account. In addition, there are projects that you finance for several months, and only then begin to receive a return on investment from them.

And we do the same for all existing projects on a monthly basis.

Do not duplicate or confuse individual indicators

Keep in mind that if you keep records of receipts without VAT, accordingly, its amount paid to the budget should not be included in the payment plan, since it is already “as if paid”. But to complete the picture, it is better to keep records of both revenue and cost including VAT, and take into account its amount in taxes planned for payment.

The same applies to depreciation charges. If you keep a record of them as part of the costs, do not forget to reflect the increase in the size of the depreciation fund in the cash balance, because. these funds are essentially real money, and when buying or repairing equipment (when spending), they are deducted from it.

It is also necessary to separate loan payments and payments to suppliers. What you pay suppliers is an expense. Interest on a loan is also an expense, and repayment of the principal amount of debts is reflected in the balance sheet as a reduction in debt to creditors.

We build a graph (table)

The principle of constructing cash flow ( cash flow ) is very simple, but very informative. We need to compare monthly revenue with expenses. You can accept other periods – at least a week, at least a quarter – but usually all payments occur within one month, and the consolidation of periods is acceptable for long-term planning of future and long-term projects, and not current and those that are already on the way.

The data taken as an example assumes the presence of profitability in the range from 10 to 20% and a certain lag in the return on invested funds from the start of project expenditures. The first project can be the main activity. And all the rest are either the same, meaning just an additional amount of work, or fundamentally different, but generating income.

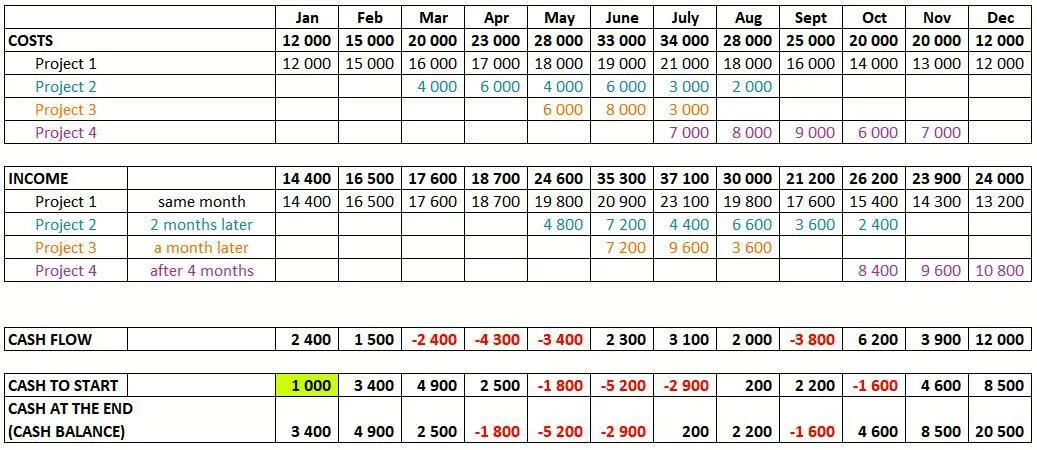

Table 1

Cash Flow Calculation Example

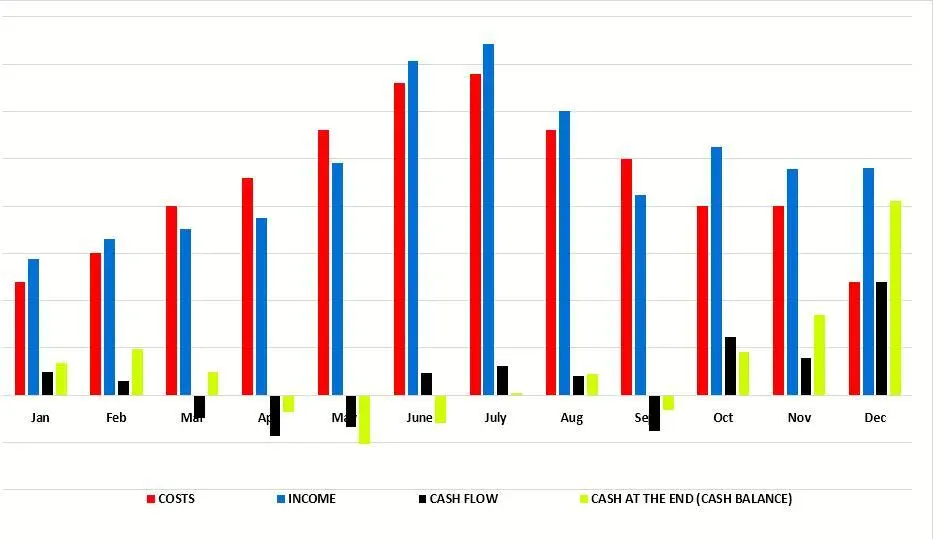

Rice. 1. Graphical display of cash flow to Table 1

Explanations

Cash flow is defined as the difference between receipts and expenditures over a period—in our case, a month.

Cash at the beginning – in our example, this is a conditional 1000 rubles. free cash that you have at the very beginning of the period under review. It can be equal to zero or negative – but it should reflect the real state of affairs at the moment.

Accordingly, the amount at the end of the period is the amount of money at its beginning plus cash flow.

The amount at the beginning of each period is the amount at the end of the previous period, so in the table the amount at the end changes on an accrual basis throughout the year, incorporating the cash flow values in each of the periods.

Конец ознакомительного фрагмента.

Текст предоставлен ООО «ЛитРес».

Прочитайте эту книгу целиком, на ЛитРес.

Безопасно оплатить книгу можно банковской картой Visa, MasterCard, Maestro, со счета мобильного телефона, с платежного терминала, в салоне МТС или Связной, через PayPal, WebMoney, Яндекс.Деньги, QIWI Кошелек, бонусными картами или другим удобным Вам способом.

Интервал:

Закладка:

![О Генри - Золото и любовь [Mammon and the Archer]](/books/1083454/o-genri-zoloto-i-lyubov-mammon-and-the-archer.webp)