Anatoly Kondratenko - Probabilistic Theory of Stock Exchanges

- Название:Probabilistic Theory of Stock Exchanges

- Автор:

- Жанр:

- Издательство:неизвестно

- Год:2022

- ISBN:нет данных

- Рейтинг:

- Избранное:Добавить в избранное

-

Отзывы:

-

Ваша оценка:

Anatoly Kondratenko - Probabilistic Theory of Stock Exchanges краткое содержание

Probabilistic Theory of Stock Exchanges - читать онлайн бесплатно ознакомительный отрывок

Интервал:

Закладка:

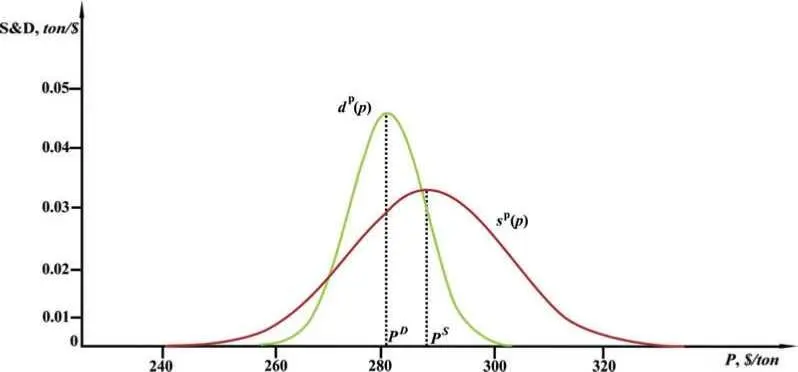

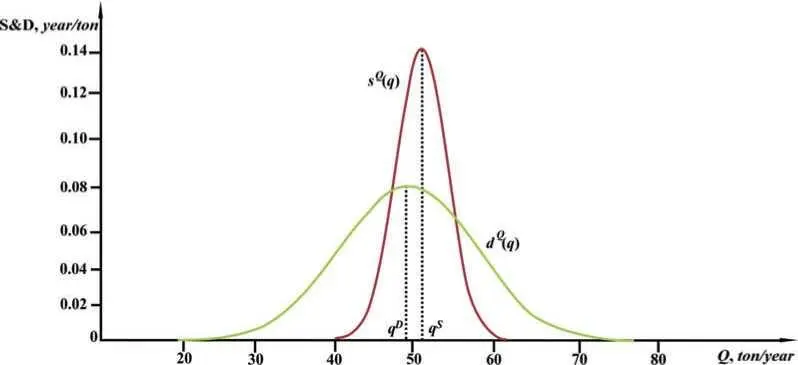

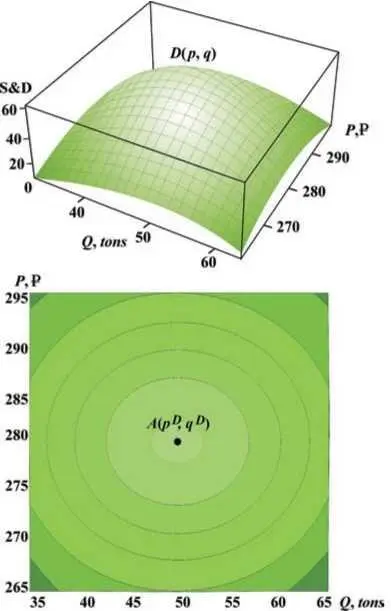

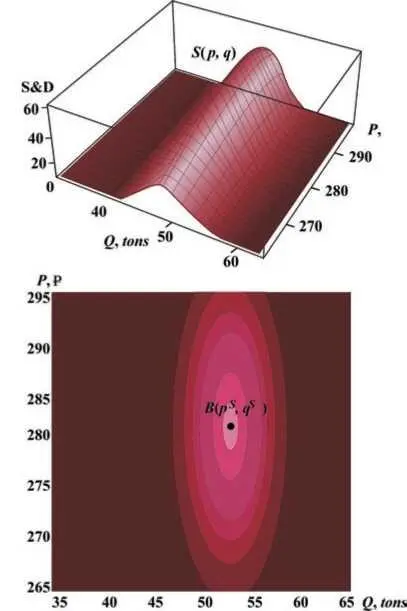

For our model grain market the probability functions S&D are presented graphically in Figs. 1.6–1.9.

Obviously, for a two-agent economy, all S&D market function surfaces have a simple smooth structure with one maximum. Of course, for more complex economies the structure of the surfaces will be much more complex.

Fig. 1.6. Graphical representation in the rectangular two-dimensional coordinate system [P, S& D] of one-dimensional price functions d P ( p ) and s P ( p ) as two-dimensional curves with maxima at prices p D and p S and widths Г DР and Г SР respectively. The values used for the widths are: Г DР = 23.8 $/ton, Г SР = 37.0 $/ton.

Fig. 1.7. Graphical representation in the rectangular two-dimensional coordinate system [P, S& D] of one-dimensional quantity functions d Q ( q ) and s Q ( q ) as two-dimensional curves with maxima at quantities q D and q S and widths Г DQ and Г S Qrespectively. The values used for the widths are: Г DQ= 26.4 ton / year, Г SQ = 6.8 ton/year.

Below we will discuss in detail all new concepts, main features and calculation details for our simplest two-agent system, so that we will not be distracted by their discussion in further consideration of more complex issues concerning the exchange. So, by definition and in its essence, the probabilistic function of demand D ( p,q) (supply S ( p,q )) is the probability of the buyer (seller) concluding a deal to buy and sell the traded goods in quantity q at price p . If this is so, then, according to the standard concepts of probability theory, it is natural to define the probability of the transaction under these conditions as the multiplication of these probabilities:

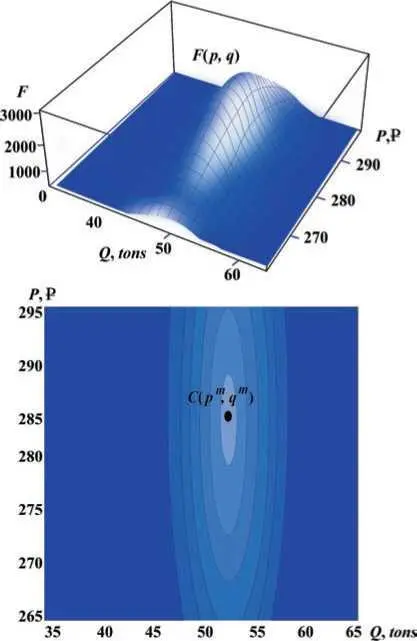

We call this probability of making a deal a market deal function, and, for convenience, we also refer it to the market functions of supply and demand. Like the market functions D ( p, q ) and S ( p, q ), it is dimensionless. For the sake of certainty, let us explain that, generally speaking, purchase and sale transactions can occur in the market at any time, at any price and in any quantity, within reasonable limits, but with varying degrees of probability. But if the transaction function is a sufficiently high and narrow bell with a single maximum with the parameters p M and q M, then almost all transactions will occur in the proximity of these values, so it is reasonable to consider these very values to be market prices and quantities. If the function of transactions looks otherwise, of course, these definitions are somewhat meaningless, and one should consider the mechanism of probabilistic pricing in detail. Below we will always assume that the function of transactions is such as to allow market prices and quantities to be determined in a fairly simple way. This is exactly the case we have graphically presented in Fig. 1.10 for our two-agent model of the grain market.

Fig. 1.8. Graphical representation in a rectangular three-dimensional coordinate system [P, Q, S&D] of the two-dimensional buyer demand function as a three-dimensional surface D ( p, q ) with a maximum at the point A ( p D, q D) in the plane (P, Q).

Fig. 1.9. Graphical representation in the rectangular three-dimensional coordinate system [P, Q, S&D] of the two-dimensional seller's supply function as a three-dimensional surface S ( p, q ) with a maximum at point B ( p S, q S) in the plane (P, Q).

As expected, the surface of the market transaction function F ( p, q ) has only one maximum. For multi-agent economies, the structure can be much more complex.

Fig. 1.10. Three-dimensional graphical representation in a rectangular three-dimensional coordinate system [P, Q, F] of the three-dimensional deal surface F ( p, q ) in the form of a high and narrow bell with one maximum at the point C ( p M, q M ) in the plane (P, Q). The graphical method of calculation gives the following results for market prices and quantities: p M= 281.4 $/ ton, q M= 51.9 ton / year .

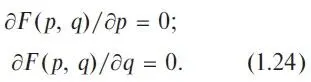

Let us now turn to the question of calculating market prices and quantities within the framework of probabilistic economics. It is well known from the standard course of mathematical analysis that extrema of a multidimensional function should be defined as points on the corresponding surface in which the total differential of this function is 0. In our situation this condition leads to the following equation:

This equation is equivalent to the following two partial derivative equations:

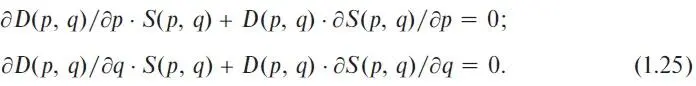

In terms of S&D functions, this system is transformed as follows:

At this point it makes sense to introduce a new concept into theory, namely the concept of S&D market forces with such definitions:

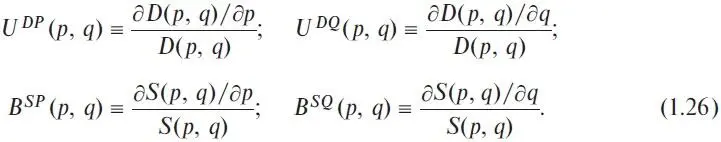

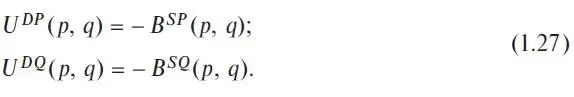

In terms of market forces we can write the system of equations (1.25) more compactly as follows:

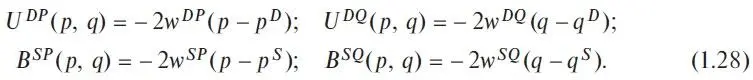

Obviously, this system of equations looks like a system of equality of S&D market forces at values of market prices and quantities. And it is similar to the system of forces equality at the static equilibrium point in classical mechanics. In other words, the system of economic equations (1.27) looks like a formulation of Newton's third law in classical mechanics. Substituting specific S&D functions from equations (1.16) and (1.20) into the system of equations (1.26), we obtain such simple and clear formulas for calculating market forces:

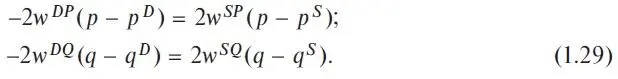

As we can see, all forces have become one-dimensional functions in this model. Then, using these equations, we obtain a very elegant system of two independent linear equations to determine market prices and quantities:

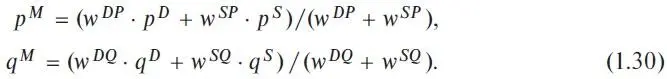

This system is so simple that you don't even have to solve it in the usual sense to get a very nice looking solution for market prices and quantities:

Thus, probabilistic market prices and quantities in a two-agent economy, when using factorized agent functions in the form of Gaussians, are determined by averaging the corresponding agent parameters, with the frequency parameters of the agents serving as weights in this averaging. The fundamental point here is that these two simple, and independent, algebraic formulas, which include only four buyer parameters ( p D

Конец ознакомительного фрагмента.

Текст предоставлен ООО «ЛитРес».

Прочитайте эту книгу целиком, на ЛитРес.

Безопасно оплатить книгу можно банковской картой Visa, MasterCard, Maestro, со счета мобильного телефона, с платежного терминала, в салоне МТС или Связной, через PayPal, WebMoney, Яндекс.Деньги, QIWI Кошелек, бонусными картами или другим удобным Вам способом.

Интервал:

Закладка: